Precision Agriculture: Market Analysis and Trends in Predictive Models and Autonomous Systems

- Tim Bright

- May 21, 2025

- 8 min read

Updated: Sep 19, 2025

The proliferation of AI models and automation technology is reshaping modern economies. In the Agrifood sector, precision agriculture, which encompasses advancements in robotic and autonomous agricultural vehicles, as well as automation facilitated by artificial intelligence (AI) and software, is experiencing rapid growth driven by these innovations. The World Intellectual Property Organization's (WIPO) 2024 AgriFood report provides an overview of the patent landscape of precision agriculture, also known as precision farming or smart farming.

The Agrifood sector is related to the production, processing, and distribution of food and agricultural products. Agrifood comprises two subcategories, AgriTech and FoodTech. AgriTech refers to systems used to accomplish agricultural activities, while FoodTech relates to food preparation and distribution activities in the latter stages of the food production pipeline.

Over the past 20 years, these sectors have driven significant innovation, with over 3.5 million patents being filed. AgriTech accounts for 60% of the total patent count (2.1 million), while FoodTech comprises the remaining 40% (1.5 million). AgriTech leverages emerging technologies to enhance crop yields, optimize water usage, and improve soil health.

Emerging technologies enable farmers to deploy systems that autonomously plant, harvest, and maintain crops. For example, the engineers at Carbon Robotics have developed a series of autonomous farming machines equipped with laser-weeding systems. This analysis focuses on WIPO’s 2024 report, with a particular emphasis on robotics and autonomous systems, key market players, and emerging industry trends through 2025 and beyond.

Core Technologies Driving the Sector

Innovation within AgriTech is concentrated in predictive models in precision agriculture, with patent filings in this field increasing 27.1% annually. Also significant, patent filings for autonomous devices in precision agriculture have experienced an annual growth rate of 10.4%. Innovation in both subcategories is dominated by corporate players, with much overlap between categories.

IPCs of Main Application Areas In Precision Agriculture:

A01b: Soil working

A01D: Harvesting and mowing

A01G: Horticulture

A01k: Animal husbandry, aviculture, apiculture, pisciculture; fishing

A01C: Planting, sowing, fertilizing

A01M: Catching, trapping, or scaring of animals

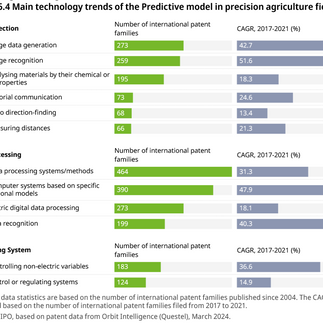

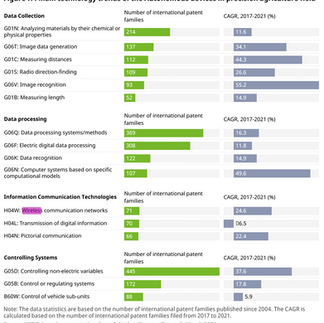

FIG 6.5 and FIG 7.5

Predictive Models and Autonomous Systems Overview

Predictive model integration extends beyond soil analysis and robotic control tasks. Farmers utilize AI's predictive capabilities to forecast market demand and develop planting plans that yield the highest return on investment.

The application of autonomous machinery and robotics in precision agriculture enhances the efficiency of crop planting, management, irrigation, and harvesting. The patent landscape in this field emphasizes the use of autonomous guidance technology to assist machines dedicated to crop cultivation and food processing.

The technologies involved in predictive models and autonomous systems can be categorized into four main areas: data collection, data processing, information communication technologies, and controlling systems. The application of predictive models and autonomous machinery enhances the precision and efficiency of agriculture and also promotes a shift towards intelligent and data-driven agricultural practices.

Technologies Driving Innovation in AgriTech Predictive Models and Autonomous Systems:

Data collection

Advances in data collection techniques enable granular monitoring of crop growth conditions and other environmental parameters. Farmers have access to previously unheard-of levels of data about their farmland. Internet of Things (IoT) devices facilitate real-time data collection and analysis from diverse sources, including cameras, temperature sensors, moisture sensors, and accelerometers. Further, local data sources can be coupled with satellite imagery and weather information to enable robust analysis and provide decision support.

Data processing

Machine learning models, sensor fusion techniques, data classification, and correlation methods are utilized to transform raw data into actionable insights. AI models perform the computational analysis that enables activities such as assessing crop health, predicting pest infestations, and optimizing the growth environment.

Information communication technologies

Connectivity/sensors/smart farming is built upon the foundation of interconnected devices and IoT sensors that synergize with wireless telematics to promote remote steering, sensing, and data collection.

Controlling systems

Control of non-electric variables and other critical parameters requires specialized controlling systems that integrate computational intelligence into physical farming equipment. For example, controlling systems can automatically adjust irrigation systems, fertilization equipment, and pesticide sprayers. Algorithmic control of these systems reduces guesswork while increasing efficiency and crop yields.

Global Technology Overview

The data illustrate that innovation tends to follow the innovators. Regional technology centers, such as those in the U.S., China, and Germany, are among the top filing jurisdictions in AgriTech technologies. However, the international patents filed in each country are concentrated around technologies that reflect the country's industrial composition.

U.S. dominance remains strong, but international patent filings in the AgriFood sector have experienced a calculated annual growth rate (CAGR) decline of -4.1%. India and China have experienced CAGRs of 11.2% and 8.5%, respectively, from 2017 to 2021. International growth in the AgriFood sector is driven by predictive systems and IoT technologies that facilitate the automation of the agricultural value chain.

Industrial manufacturers like Deere and Kubota lead the way in automation and precision agriculture, as reflected in the large number of international filings attributed to their home countries, the U.S. and Japan, respectively. Global investment in AgriFood technology has grown from approximately US$3 billion in 2012 to nearly US$30 billion in 2022. Understanding the market's geographic composition is essential for developing a winning patent strategy.

International AgriTech Patent Filings

Most jurisdictions exhibit similar distributions of international patent filings among AgriTech subcategories, with the highest numbers of international patent filings in the pest/disease management and crop adaptation and genetics categories. However, international patent filing data can be used to highlight regional market demands.

Germany's unique profile focuses more heavily on connectivity/sensors/smart farming/planting/harvesting/storage, and water management innovations. Other market-specific factors relate to jurisdictions known for global meat exports (e.g., Spain, Taiwan, and Denmark), where over 10% of international filings were focused on livestock management technologies.

International Patent Filing for Predictive Models and Autonomous Devices

International patent filings for predictive models and autonomous devices in precision agriculture reveal market trends and highlight the regions most active in precision agriculture. Analysis of the patent landscape for predictive model techniques and autonomous systems used in AgriTech shows a global trend toward data-driven systems that assist in crop cultivation and food processing.

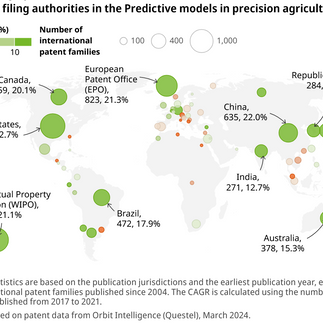

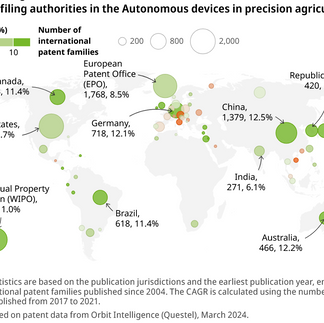

Analysis of international patent filings between 2017 and 2021 reveals that the statistics for both predictive models and autonomous devices in precision agriculture follow similar patterns. The United States Patent and Trademark Office (USPTO), the World Intellectual Property Organization (WIPO), and the European Patent Office (EPO) are the leading global authorities for patent filings. In Asia, China boasts the most international filings, followed closely by Japan and the Republic of Korea.

First Priority Filing Data

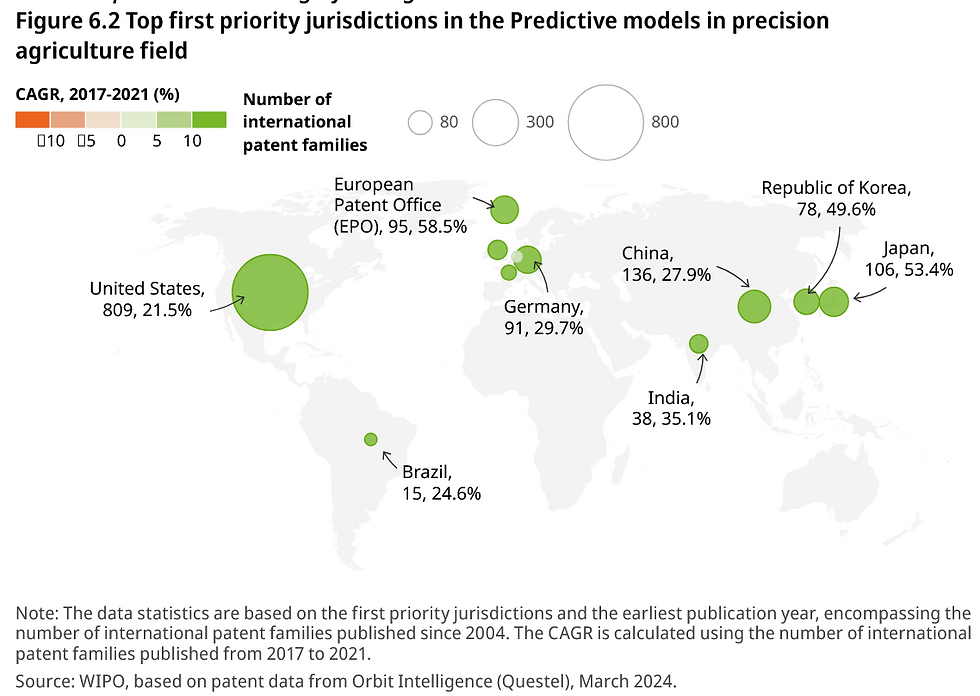

First-priority filing data provides insight into the R&D activities within a jurisdiction. Leadership in first-priority filings in the predictive models subcategory aligns with general international filing trends, with the U.S. in the lead, followed by China, Japan, and the European Patent Office (EPO).

Analysis of CAGR from 2017 to 2021 indicates that R&D efforts in the predictive model subcategory have experienced rapid expansion. Notable jurisdictions, including the EPO (58.5%), Japan (53.4%), the Republic of Korea (49.6%), India (35.1%), Germany (29.7%), and China (27.9%), continue to drive innovation.

R&D efforts for autonomous devices in precision agriculture continue the trend of U.S. dominance. However, regional analysis indicates that Europe is the leader in R&D efforts for autonomous devices, with 1,279 international patent families in the field. Asia is second with 1,177 international patent families. North America is third with 1,040 international patent families. Regional interest in autonomous devices in precision agriculture suggests a desire to gain access to modern farm equipment and to enhance agricultural productivity.

First-priority filing data demonstrate growth across all regions for autonomous devices in precision agriculture. Several jurisdictions, including Brazil (69.5%), Japan (38%), and the Republic of Korea (30.0%), stand out in their pursuit of innovation in the field.

Top Players in Predictive Models and Autonomous Devices

Deere is the leading AgriTech innovator and holds a diverse international patent portfolio that covers agricultural farming machines, predictive models, and autonomous devices. Many of the major players active in agricultural equipment manufacturing are also top players in autonomous device control technologies. Innovations in auto-steering and remote operation are natural extensions of their existing portfolios, helping to increase farming sustainability and efficiency while reducing repetitive drudgery.

Many applicants involved in predictive models hailed from the tech sector rather than industrial machines or equipment manufacturing. Top applicants in the predictive models for the precision agriculture field include Deere, as well as the two German chemical companies Bayer and BASF, which lead in international patent families in this field. Their technologies cover predictive crop state and characteristic mapping, predictive nutrient mapping, predictive harvesting models for machine control, predictive yield mapping, and more.

Technology companies involved in precision agriculture utilize farming data gathered from sensors, farm equipment, and satellites to train predictive models. Few actors are as prolific as Deere, and many top applicants maintain focused portfolios that concentrate on applying predictive models to enhance tasks within a specific knowledge space. Alphabet, for example, holds a portfolio focused on the aquaculture and fish feeding industries.

Furthermore, there has been a relatively small number of international patents filed in this category over the last 20 years. Deer holds 118 patent families, and the fourth largest applicant, Mineral Earth Sciences, has 21. However, analysis of CAGR from 2017 to 2021 indicates rapid expansion, with notable jurisdictions like the European Patent Office (58.5%), Japan (53.4%), the Republic of Korea (49.6%), India (35.1%), Germany (29.7%), and China (27.9%) driving innovation. This vigorous annual growth, even with smaller existing portfolios for some, suggests that the field is still in a dynamic phase of maturation and expansion, not saturation.

Industry Trends and Future Outlook

As the relevant technologies mature, precision agriculture evolves toward zero-input farming, where crops are planted, harvested, processed, and distributed entirely through automated systems. Carbon Robotics, an American company, has developed technology that provides a template for sustainable intensification, reducing chemical inputs while maintaining, or even increasing, productivity.

Their laser weeder platform (U.S. Patent # 11,602,143) distinguishes between crops and weeds. FIG. 9 above highlights the method for Carbon’s weed eradication method, which requires an interdisciplinary approach that combines computer vision, AI deep learning technology, robotics, and lasers.

The company has developed multiple solutions to address the needs of farmers transitioning to precision agriculture technologies. Carbon’s auto tractor system is a retrofit kit that enables autonomous and remote control of existing tractors. By providing value-adding technology and lowering the barriers to adoption, Carbon has enabled the production of systems that address agriculture’s growing labor shortages and increase return on investment.

Conclusion

AgriTech refers to the integration of advanced technologies into agriculture to enhance productivity, sustainability, and resilience throughout the food value chain. It encompasses a wide array of innovations, including precision farming, smart sensors, biotechnology, and robotics, all aimed at transforming traditional agriculture to meet the challenges of the 21st century.

WIPO’s 2024 report on the AgriFood sector highlights a significant increase in international patent filings for predictive models and autonomous device technologies in the field of precision agriculture. The report provides granular insight into the relevant technologies and the global distribution of top players. Patent professionals in AgriTech can use the information contained therein as a starting point for an international patent strategy, market analysis, and patent valuation assessments.

Are you ready to protect your AgriTech invention? Contact Bright-Line IP to develop a robust international patent strategy.

Source:

WORLD INTELL. PROP. ORG., PATENT LANDSCAPE REPORT ON AGRIFOOD (2024), https://www.wipo.int/publications/en/details.jsp?id=4757&plang=EN.

Comments